-

THE HIGH COURT FREEZES KENYA PIPELINE COMPANY ACCOUNTS OVER 500 MILLION DEBT

THE HIGH COURT FREEZES KENYA PIPELINE COMPANY ACCOUNTS OVER 500 MILLION DEBT

-

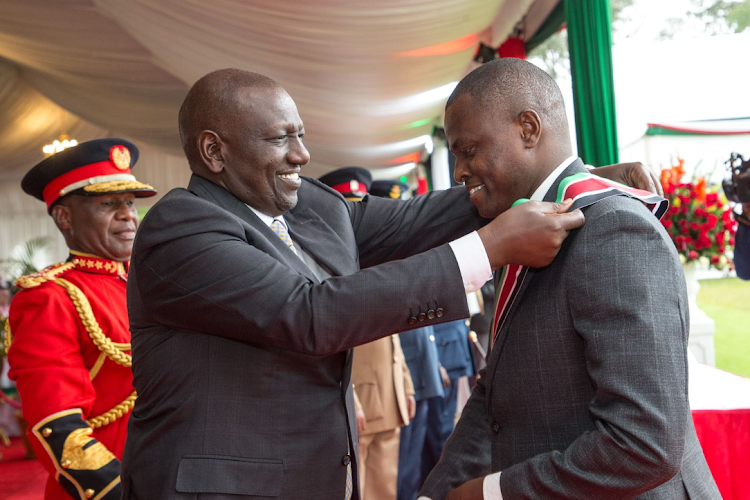

RUTO APPLAUDS POLICE EFFORTS IN MAINTAINING PEACE

RUTO APPLAUDS POLICE EFFORTS IN MAINTAINING PEACE

-

Netanyahu Accepts Trump-Brokered Ceasefire Deal

Netanyahu Accepts Trump-Brokered Ceasefire Deal

-

ACTIVIST MORARA KEBASO QUITS POLITICS

ACTIVIST MORARA KEBASO QUITS POLITICS

-

KENYA AND CHINA FINALIZE LOAN DEAL

KENYA AND CHINA FINALIZE LOAN DEAL

-

Officers, Civilians Charged in Death of Blogger Albert Ojwang in Police Custody

Officers, Civilians Charged in Death of Blogger Albert Ojwang in Police Custody

-

Missile Blasts Over Doha After Qatar Shuts Airspace Amid Iran–US Escalation

Missile Blasts Over Doha After Qatar Shuts Airspace Amid Iran–US Escalation

-

KRA ANNOUNCES NEW CHANGES TO PAYE FILING SYSTEM

KRA ANNOUNCES NEW CHANGES TO PAYE FILING SYSTEM

-

Eric Mutinda, MMU Student Accused of Girlfriend's Murder, Declared Unfit to Stand Trial

Eric Mutinda, MMU Student Accused of Girlfriend's Murder, Declared Unfit to Stand Trial

KENYA'S BITTER PILLS, LOANS

Kiharu MP, Ndindi Nyoro has warned that the country is currently in a debt crisis and inclined towards joining Africa's debt defaulters club.

During an annual budget review at the Institute of Public Finance , the former Budget and Appropriations Committee Chairman stated that the country’s public debt is worrying and adding more would be hazardous.

Central Bank of Kenya in there data revealed that, as of December 2024, Kenya owed its lenders Ksh.10.9 trillion—approximately 54 percent owed to local lenders, while 46 percent from external sources

Ruto’s tenure which was pledging to significantly work on the debt has instead added more than two trillion from the original 8.7 trillion when , the public debt has increased by more than Ksh.2 trillion from the original Ksh.8.7 trillion.

MP Nyoro suggests that, based on the happening, Ksh.750 billion will have to service the domestic debt, while Ksh.200 billion for the external ones.

“Any indication that we are going to default or are unable to service our loans is more catastrophic to our economy,” Nyoro added.

Nyoro who was some time back defending the government over its loaning seem to be in double speech after his most recent remarks.

He also said the increase in taxes since 2022 has had a negative impact on the economy.

“Increasing taxes to get more revenue is a fallacy. By increasing taxes, you distort economic decisions. If I was planning to buy a car, I would withhold that decision because the government is coming for my money. That means even the little revenue you would have gotten—you won’t get it,” said the Kiharu legislator.

Comments (0)

No comments yet. Be the first to comment!