-

HAWKER SHOT DURING NAIROBI PROTEST SUCCUMBS TO INJURIES

HAWKER SHOT DURING NAIROBI PROTEST SUCCUMBS TO INJURIES

-

AGRICULTURE MINISTRY LAUNCHES AUDIT COMMITTEE TO BOLSTER TRANSPARENCY

AGRICULTURE MINISTRY LAUNCHES AUDIT COMMITTEE TO BOLSTER TRANSPARENCY

-

BLOGGER FRANCIS GAITHO TO BE ARRESTED

BLOGGER FRANCIS GAITHO TO BE ARRESTED

-

KURIA:KALONZO KNOWS 2027 ELECTIONS WON’T HAPPEN, BUT WON’T ADMIT TO IT.

KURIA:KALONZO KNOWS 2027 ELECTIONS WON’T HAPPEN, BUT WON’T ADMIT TO IT.

-

ISIOLO GOVERNOR TO FACE SENATE OVER IMPEACHMENT DESPITE COURT ORDER

ISIOLO GOVERNOR TO FACE SENATE OVER IMPEACHMENT DESPITE COURT ORDER

-

KENYA BEGINS EVACUATION OF CITIZENS FROM IRAN

KENYA BEGINS EVACUATION OF CITIZENS FROM IRAN

-

KDF OFFICERS TO START PAYING FOR FOOD FROM TUESDAY

KDF OFFICERS TO START PAYING FOR FOOD FROM TUESDAY

-

KALONZO SET CONDITIONS TO WORK WITH RUTO

KALONZO SET CONDITIONS TO WORK WITH RUTO

-

GOVERNMENT SHUTS DOWN 35 HOSPITALS FOR SHA FRAUD

GOVERNMENT SHUTS DOWN 35 HOSPITALS FOR SHA FRAUD

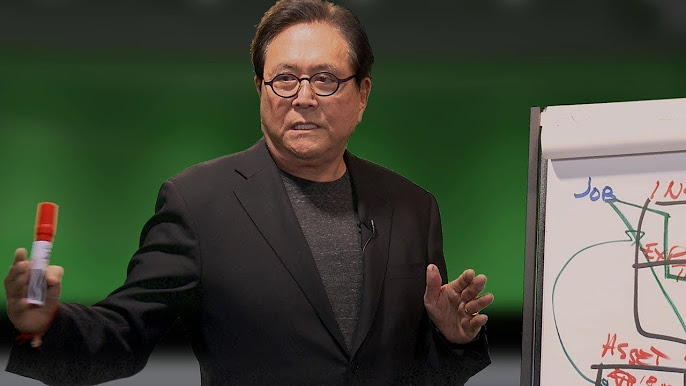

KIYOSAKI: WHY MOST PEOPLE ARE POOR

In a recent post on X , American business man and author of the best selling “Rich Dad Poor Dad,” Robert Kiyosaki has delved into two rules that explain why some people remain poor as other build financial muscles .

He dubbed them as the "Laws of Money," warning that breaking them is ingredient for financial poverty.

Law 1: Gresham’s Law

This is an economic principle that states that “bad money drives out good money." Kiyosaki termed this as; “When bad money enters a system….good money goes into hiding." In application to the currency markets, he highlighted that, "the law states that legally overvalued currency will drive legally undervalued currency out of circulation."

The Investment Sage summarised the law as a call for people to focus more on obtaining income generating assets instead of abitrarily piling cash in the name of saving.

“In ‘Rich Dad Poor Dad’ I stated, ‘Savers are losers, In 2025, poor people are working for and saving fake money and not saving real money … gold, silver, bitcoin," he wrote.

Law 2: Metcalfe’s Law

Metcalfe’s Law deals with the power of networks, stating that “the value of a network grows as the square of the number of its users.”

In explaining this, he compared various business ventures in the US , showing the network - oriented ones as successful than those void of the same.

“McDonald’s is a franchise network,” while “Mom Pop burgers is not. That’s why they’re poor," he sampled , FedEx is a network. Joe’s one truck package delivery is not.”

Kiyosaki explained that the principle functions in dictating the cryptocurrencies that are ideal for investments, furthering that the currencies with the broad network bands are the most worthwhile.

“I invest in bitcoin because [it] is a network, Most cryptos are not, " he wrote.

Kiyosaki continued maintaining that his results are a prototype of obedience to these laws, investing in income generating things ( assets) and saving currencies, that have hightened networks or value instead of common cash.

“If you want to be rich, obey the laws,” he wrote on X. “Michael Saylor’s rich man’s words of wisdom are: ‘Only invest in things … a rich person will buy from you.’ Think about that.

“I do not save U.S. dollars because the U.S. dollar violates Gresham’s Law,” Kiyosaki furthered. “I do not invest in … coins without networks, because they violate [Metcalfe’s] Law. That’s why I save gold, silver and acquire bitcoin. They obey the laws, " he enhanced.

Comments (0)

No comments yet. Be the first to comment!