-

Officers, Civilians Charged in Death of Blogger Albert Ojwang in Police Custody

Officers, Civilians Charged in Death of Blogger Albert Ojwang in Police Custody

-

Missile Blasts Over Doha After Qatar Shuts Airspace Amid Iran–US Escalation

Missile Blasts Over Doha After Qatar Shuts Airspace Amid Iran–US Escalation

-

KRA ANNOUNCES NEW CHANGES TO PAYE FILING SYSTEM

KRA ANNOUNCES NEW CHANGES TO PAYE FILING SYSTEM

-

Eric Mutinda, MMU Student Accused of Girlfriend's Murder, Declared Unfit to Stand Trial

Eric Mutinda, MMU Student Accused of Girlfriend's Murder, Declared Unfit to Stand Trial

-

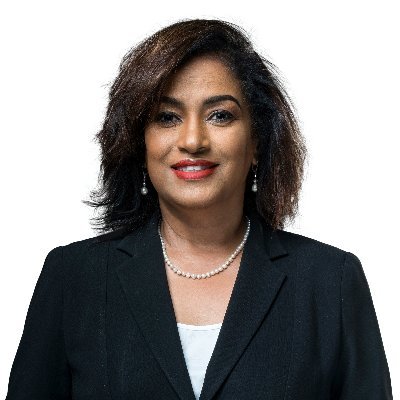

PASSARIS OFFERS KSH100K REWARD FOR INFORMATION ON ABIGAEL’S MURDER

PASSARIS OFFERS KSH100K REWARD FOR INFORMATION ON ABIGAEL’S MURDER

-

GOVERNMENT PROHIBITS USE OF 77 PESTICIDES OVER SAFETY CONCERNS

GOVERNMENT PROHIBITS USE OF 77 PESTICIDES OVER SAFETY CONCERNS

-

ICHUNG'WAH : WE PASSED THE 2024 FINANCE BILL SECRETLY

ICHUNG'WAH : WE PASSED THE 2024 FINANCE BILL SECRETLY

-

MOHAN GALOT DIES AT 80

MOHAN GALOT DIES AT 80

-

MOSES KURIA'S PATH TO REBELLION

MOSES KURIA'S PATH TO REBELLION

KRA ANNOUNCES NEW CHANGES TO PAYE FILING SYSTEM

The Kenya Revenue Authority (KRA) has announced significant changes to the process of filing Pay As You Earn(PAYE) returns, introducing a streamlined system aimed at easing compliance for employers. Effective as from July 1, the new platform is designed to simplify the monthly tax return process, especially for organizations managing numerous payroll deductions. This development comes in response to widespread calls from employers across various sectors for reforms that reduce paperwork, minimize filing errors, and modernizing payroll compliance.

KRA revealed that the revamped system was developed based on feedback from taxpayers. The system allows employers to file returns based on employee categories. It will also feature integrations with key government systems including the Government Human Resource Information System(GHRIS), the Integrated Financial Management Information System(IFMIS), and the Central Bank of Kenya(CBK) via API connections. These integrations will facilitate seamless filing and payment of PAYE, the Affordable Housing Levy, NITA Levy, and other statutory deductions.

The simplified PAYE return system aims to enhance the overall user experience for employers in the public, private and non-profit sectors. To use the simplified system, employers will need to download a specially formatted Excel file known as the Simplified Excel PAYE Return from the KRA website. The tax authority has asked employers to familiarize themselves with the new system and begin adjusting their payroll processes accordingly to avoid last minute challenges.

Comments (0)

No comments yet. Be the first to comment!